By Hemal Rawal

Vice President, Claret Capital Partners

Amazon is the first destination for more than 50% of product searches and a flywheel to its continued retail success, as the “everything store”, is the large universe of third party sellers using fulfilled by Amazon (“FBA”).

The market is huge – according to marketplace pulse, Amazon’s marketplace accounted for approximately $300bn in sales in 2019 and growing. The size of the European market from the different sources we have seen estimates Europe’s share between $30bn – $40bn.

Tushar Ahluwalia and Christoph Gamon are the co-founders of our portfolio company Razor Group, an acquirer of 3rd Party Sellers (3PS). Claret is pleased to have backed Razor (AGAIN!) with a new growth capital round. In collaboration with Tushar and Christoph, we discuss the playbook for FBAs.

What exactly is the roll up strategy of 3rd party sellers (predominantly on Amazon) all about?

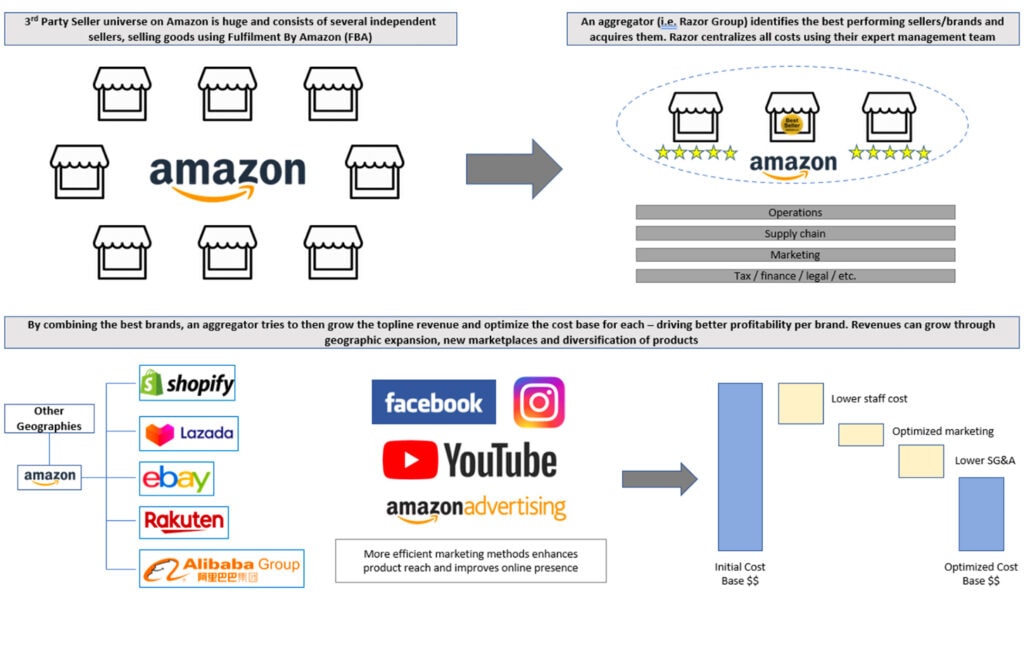

Aggregators scrape the Amazon universe of brands selling through their platform within a specific vertical, i.e. household goods. A proprietary scraper, typically identifies the best performing brand within a category using search parameters such as the highest customer rating or one that is branded a “best seller” by Amazon themselves.

Aggregators then approach the owners of the identified “best brands” and acquire them, put them together and take over all of the operations of that business and centralise all costs.

The aggregator’s expert management team run these brands with a view to increasing revenue and optimising costs thus driving better profitability. They achieve this by selling across channels or geographies, improving marketing techniques and recognising cost synergies. These synergies drive a much higher multiple over time than that paid for the asset originally.

Why is the acquisition of small merchants on the Amazon platform rapidly accelerating in Europe?

When Claret first looked at the space, there were 4 emerging players in Europe – Razor Group being one of them, who were looking to replicate the model pioneered by Thrasio in the US. Since September 2020, the number of new entrants has exploded across Europe, with several companies raising equity rounds in Germany, France, Spain and the UK. Claret alone has seen over 16 new companies in Europe, but we believe there are probably twice as many venture backed FBA aggregators out there, not to mention those that are now turning their attention to Asia and Latin America, both markets for e-commerce, which are much bigger than Europe.

“Claret has been an exceptional partner since Day 1. We chose to partner with Hemal and the team very early on in our journey (even before our 1st acquisition) and quickly developed a trustworthy and positive relationship since. Claret is not just a debt investor, but an important strategic advisor to us as Founders and an investor who can think across the capital structure. This mindset and flexible debt capital has helped bring our high-growth venture strategy to life.” – Tushar Ahluwalia

Equity and debt capital is in plentiful supply in this space which is fuelling the launch of new players. Debt in particular is one of the most important forms of finance for this model, without which these businesses would not be able to scale at the rate they are. The underlying sentiment is that it’s a big enough market to accommodate a number of successful players at scale.

Selling online is difficult. Traditional e-commerce businesses spend 25% – 30% of their transacted volumes on marketing alone and consumers are not overly “loyal”, therefore to retain customers a business must keep spending on marketing. Amazon solves for this to an extent – customers are loyal to Amazon (especially those who pay a prime subscription fee) and use Amazon as their primary destination to acquire goods. The illusion of free shipping and a sole place to buy everything a consumer needs makes acquiring sellers on Amazon very attractive.

“One of the key reasons for so much capital to flow into this model is certainly the success of Thrasio. The US role model has raised >$1.5bn in equity and debt financing and consolidated >$500m in revenue and

>$100m in EBITDA within less than 3 years. This has led to the company reaching a $3-4bn valuation on the back of acquiring ~100 FBA brands. To put this into perspective: There are >3m active FBA sellers on Amazon (1.2m new sellers joined the marketplace last year alone), of which ~30k generate >$1m in annual sales.” – Christoph Gamon

Is this truly the size of the European aggregator space?

We’ve only focused on Amazon as the main marketplace and have excluded other marketplaces in Europe due to the availability of reliable figures to estimate and understand the size of the total European marketplace. The real size of the market for ALL e-commerce sellers on marketplaces in Europe must therefore be much larger than $40bn. From the data we have, Amazon only has c.10-11% market share in Europe. If we extrapolate this, we can conclude that the total addressable market for Europe is approximately $350bn – $400bn in size.

“There is a reason why the aggregators are initially focusing on Amazon FBA sellers. By enabling sellers to

leverage its e-commerce infrastructure (storage, fulfilment, shipping, customer support etc.), Amazon has created an ecosystem of highly standardized assets that can be operated with reduced requirements for staff, marketing capabilities etc. This allows aggregators such as Razor Group to rapidly identify, diligence and integrate multiple such assets in parallel. The model can therefore reach scale much faster than a typical Private Equity roll-up play. And the cherry on top: Well-run FBA sellers typically operate at very attractive EBITDA margins and cash flows from Day 1.” – Christoph Gamon

Rapid creation of a large “digital” consumer goods brand

It has long been a trend for a number of consumer-focused businesses to start out by selling their product on a marketplace. It’s the quickest way for them to get their product to a mass market without having “all of the expertise” in everything else needed to grow a successful e-commerce company.

Companies such as Razor have management teams who are vastly experienced in e-commerce – from excellence in operations, marketing, sourcing, HR, accounting, technology etc. they build teams solely to acquire and run these businesses at a larger scale with a view to growing them and driving better margins.

It is their goal to build a business akin to the traditional “aggregators” like Unilever, Proctor & Gamble, Reckitt Benckiser et al have built over many years. The question, which can only really be answered over time, will be whether the customer is buying Amazon as a brand vs the FBA.

Why do venture capitalists & venture lenders like the model?

Not all investors, equity or debt, like the model, which is no surprise given we as investors / lenders have verticals we prefer over others. Asset roll-ups have been the bread & butter structures for traditional private equity companies who for decades have aggregated several EBITDA profitable businesses into a single, large and dominant player within a vertical. They have used a small amount of equity and leveraged the model well such that management

teams are not reliant on consecutive equity rounds to fund growth. For lenders, there are material deployment opportunities for debt to further finance profitable acquisition targets, enhancing profitability but also generating free cash flow from realised synergies.

What are the key risks here?

Price of assets increasing:

In Europe, data points indicate “actual” valuation multiples for assets is increasing to 2x-4x EBITDA and in some cases increasing above this as well. The emerging aggregators enjoyed a short window (H2 2020), where assets were priced between 1x-3x EBITDA. There has to be a point at which the multiple on a small asset that has been trading for less than 3 years on Amazon reaches a ceiling? The hike in multiple is being driven by increased competition in the space. There will however come a point where the multiple is too large for new management teams in aggregators to justify the price for the “best” assets – it’s at this point where we may start to see less disciplined management teams falling foul of overpriced assets.

Sustainability of EBITDA:

As aggregators target larger assets, the one thing they had better be sure of is the sustainability of EBITDA. The majority of the larger debt tickets are underpinned on EBITDA performance not only as a covenant but the catalyst that drives the ability to draw more from the allocated limit. If you can’t sustain the EBITDA, it can be difficult to draw more debt capital which can slow down the hunt for new assets! That isn’t necessarily game over but the better management teams will be acquiring assets that continue to perform and grow organically post integration.

Operations:

This is the key piece for any of these businesses. It’s not “easy” to acquire assets, but I would certainly say that it’s harder operate the assets to maintain performance. Slick operations within e-commerce companies is effectively what drives margins and in the long run determines which businesses are successful. The task of operating multiple brands under one platform however that takes some doing. Investing in the operating teams who take over the running of the asset post acquisition is the key to success of this entire business model.

“The banana skin” – acquiring the wrong asset:

We have seen a number of companies with a range of scraping tools, some are much better than others – they allow a deeper set of rules / criteria to be scraped to narrow down the “best performers” but you can never get away from manual work thereafter. While automation can certainly deliver efficiencies, M&A has been and will continue to be hard work. Acquiring the wrong asset – especially early on when there isn’t enough critical mass, in terms of assets, can be fatal for an early stage aggregator.

It’s another reason why we back the Razor team. Technology is at the base of everything they do, including their due diligence processes for those scraped companies. Utilizing technology to automate parts of their M&A process drives efficiency and a deep layer of understanding on how target companies operate, making the transition from the existing owner to their own platform pretty seamless.

Too much debt too quick:

Over indebtedness is bad for any business – that said much more of an issue when you have a “mature” debt facility with the introduction of covenants – also debt still needs to be serviced. Drawing down debt and having to service interest and capital repayments is a cash out item and taking on large facilities with large commitments, minimum draws, fees in a number of areas, are cash out considerations. With sustainable EBITDA converting to cash, this becomes a much easier task but early on, it may be the equity that is servicing the loan repayments vs the cash generative asset itself.

Amazon / Marketplaces:

We have seen a lot written about Amazon themselves being one of the biggest threats to all of these players – after all the power Amazon has over access and rules of engagement are always a background threat. At present Amazon is a tollbooth on the retail highway, collecting a share of revenues (c.30% – 40%) from marketplace sales on its platform. Amazon’s 3P marketplace has been one of the key drivers of the company’s growth in recent years. Having a company like Razor, aggregating the smaller sellers, injecting working capital into the marketplace, increasing the reach of sales for these assets and therefore growing revenues per asset can only be positive for Amazon – a move by Amazon against its smaller sellers (preventing sales to such aggregators) could be negatively perceived in the overall market. If the FBA aggregator model is working for Amazon themselves, one has to ask the question – why would they kill it off?

What is the future for the aggregators beyond acquisition-led growth?

Once the inorganic growth strategy has delivered a certain level of scale, it will be important to turn to other growth initiatives to prove the long-term sustainability of this model – both on and off Amazon:

- Geographic expansion of the asset on Amazon: Bringing assets into other Amazon marketplaces in Europe, the US and Asia

- Optimization of listings and content to drive conversion rates and thus, organic rankings on Amazon

- Geographic acquisitions. The aggregators in Europe can also look to assets in the US and Asia. In the US, Amazon is the dominant player and has a sizeable operation in Asia – although Asia is a different beast altogether

• Channel expansion: It’s not all about Amazon. Expansion across other marketplaces should be seen as a positive – not only does it diversify against the perceived risk of one marketplace but in Europe at least increases the addressable market 10 fold…

“Of course it’s early days and the aggregators still have a lot to prove. Razor, was founded only 7 months ago. Nonetheless, this model is well suited for rapid execution and expansion across categories, markets and potentially even distribution channels. For example, Razor has already acquired assets in 4 countries and recently opened further offices in the UK, US and India. This is a global opportunity and Razor has started to tackle it at global scale.” – Tushar Ahluwalia

We share Tushar’s view that the sector is still in its infancy but is very exciting. The sizeable and expanding market opportunity provides sufficient upside for emerging firms like Razor, to navigate the challenges in building a category leader.

If you are the CEO of a FBA business aggregator or an investor in the space then you can contact me at hr@claret-capital.com to talk more about all things marketplaces.

##

About Claret Capital Partners

Based in London, England, Claret Capital Partners (Formerly Harbert European Growth Capital) is a Leader in European Growth Lending. The team behind Claret Capital Partners has provided growth financing to over 200 growth-stage companies throughout Europe over the last 20 years. Its mission is to provide Technology and Life Science businesses with the Growth Capital that they need to succeed, while providing a less dilutive alternative to traditional equity fundraising.

About Razor Group

Razor Group is a new-age global consumer holding based in Berlin, Germany. We partner with Amazon FBA merchants to acquire and scale highly profitable brands across categories, distribution channels and geographies.