By Bryan McLoughlin, Vice President, Claret Capital Partners

The coronavirus pandemic has altered established traveller behaviour and has provided the travel industry with an opportunity to reshape the future of the sector. The first phase of innovation put the “online” in OTA (“Online Travel Agency”) with Booking and Expedia emerging as early winners scaling through aggregation.

The future provides multiple opportunities for innovative companies. The underlying global distribution infrastructure, built for a previous era and unknown to the average traveller, remains ripe for disruption given the dominance of Amadeus, Sabre and Travelport.

Travel was one of the earliest verticals to digitalise and mature by comparison to online penetration in other verticals. Over 50% of all European travel was booked online going into the coronavirus pandemic, an adverse shock to the travel industry, but one that will only accelerate the increasing penetration of online channels[1].

Entrepreneurs and executives in the travel industry – including our very own portfolio companies Exoticca and Holidu – kindly shared their insights on the opportunities to innovate and create value going forward. We’ve distilled the highlights and learnings from our conversations below [2].

OTA ENTREPRENEURS SEE THE “UNFAIR ADVANTAGE” OVER TRAVEL INDUSTRY LEGACY PLAYERS GROWING

The OTAs are confident that the gap between themselves and the legacy travel industry players will widen. One entrepreneur estimated, in response to COVID-19 furthering consumer digital buying habits, that some 30-40% of offline travel points of sale will not open again in Spain. Furthermore, the OTAs have an edge in attracting quality marketing talent (which is needed to win in online sales and build best-in-class user experiences) and have lower overall fixed operating costs.

LARGER HOTEL PLAYERS (SHOULD) INVEST MORE IN ‘BOOKING’ TECHNOLOGY

One former travel industry executive lamented that large hotel brands are not investing enough in technology. The question is whether legacy players are spending “smartly” on innovation. Digital check-in, a product that “intuitively” should benefit from pandemic preferences, is below the expected return on investment.

“Even though there is a huge amount of intelligent technology behind digital check-in and the management of your room (opening your room with a QR code) only 5-15% of hotel guests actually make use of such functionality.” – Hotel Executive

IF YOU CAN’T BUILD IT THEN PARTNER WITH A BEST-IN-CLASS COMPANY THAT CAN

The trend of underinvestment in technology by travel industry legacy players may change post-pandemic. Under pressure to resize bloated overheads in response to COVID-19, executives at large travel companies are no longer beholden to the status quo. An investor described the legacy travel players as (largely) reliant on internally built tech infrastructures and lacking the skillset to be “digital leaders”.

Partnerships with emerging technology companies offer a fast route out of the dilemma for legacy travel players to upgrade infrastructure. It remains early in this trend, but one to watch closely, as we have already seen TUI announce its decision to partner with Swiss start-up Nesaza in June, allowing use its modular infrastructure platform for multi-day tours.

PARTNERSHIPS CAN CREATE MEANINGFUL “REACH” FOR EMERGING TRAVEL COMPANIES

The partnership playbook is not only for corporate executives as entrepreneurs also have access to the same tactics and recognise the limitations of building a better “mouse-trap” to acquire new customers. Companies cannot rely on simply increasing paid search and ad spend, but rather need to invest in building and maintaining that brand reach, which ultimately comes down to investing in people and marketing.

“You cannot believe you can conquer a market rolling out with Google alone. The banks, telcos and insurance companies have huge power and incredible market power. We could grow to a certain size doing only internet marketing but then hit a ceiling.” – OTA CEO

CUSTOMER SUCCESS IS A PRIORITY TRAVEL INDUSTRY CEOS CANNOT IGNORE

The renewed importance of investing in ‘customer experience and success’ is shared by entrepreneurs and executives alike. Customers, as one entrepreneur reinforced, were already quite sophisticated and already researched their travel before buying [pre-pandemic]. But it is not solely the preserve of luxury travel, where a larger budget can support the experience-first traveller, but a trend across the wider industry, as all travellers now seek greater itinerary flexibility and service. Those firms capable of building “margin advantages” are better placed to win as customer success will translate into higher repeat customer bookings.

“One change that is going to happen in travel (lagging behind other industries) is customers will demand more flexibility. Travel was an exception. They [travellers] will get use to those cancellation policies without penalties and whoever caters to this need will gain market share.” – B2C Traveltech CEO

BUSINESS TRAVEL IS NOT DEAD” AND REINVENTED FOR POST-PANDEMIC NEEDS

Business travel, whilst the hardest hit of the travel verticals, is not dead with several entrepreneurs doubling down on the opportunity. Those entrepreneurs reinventing the travel management company experience from legacy players like American Express and CWT, have bought more inventory and are building the infrastructure to deliver the features that post-pandemic businesses will demand.

The three most important features being: (i) sustainability reporting on CO2 emissions as, for large corporates, travel accounts for 23% of CO2 footprint; (ii) cost-control and budgeting; and (iii) knowing where employees are when they travel – especially given emerging trends in “bleisure” (business leisure) and “digital nomad” traveller profiles.

“Every month we are doubling… three weeks ago we had the same level of bookings on one single day as pre-COVID” – B2B Traveltech Executive

B2B TRAVEL REINVENTING AT SPEED ARE TURNING TO ACQUISITION-LED GROWTH

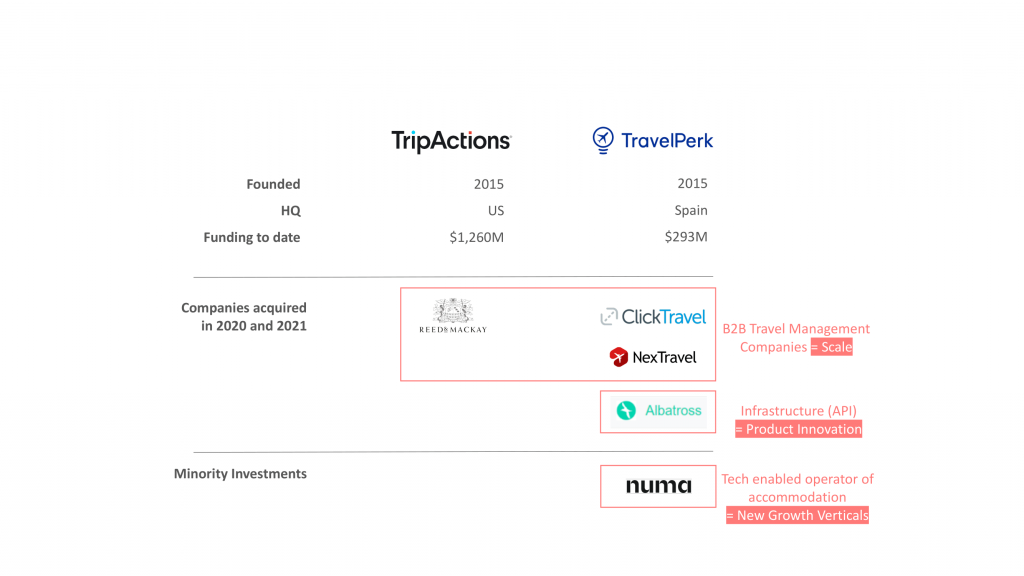

The emerging firms in the B2B travel space, with the conviction to double-down on the current opportunity, are accelerating the timescales to build a “hibernating” customer base and add new capabilities through M&A.

The offline travel management companies are willing sellers, owing to a higher fixed cost base, rooted in a low-tech, high-touch call centre operating model, with low automation and self-service.

Though, a counterfactual to this view, shared by one entrepreneur, is that corporate clients served by such firms are spending at a price point where they expect human interaction by a Travel Management Company (“TMC”) and not necessarily an online self-service. The below chart highlights key acquisitions (during the pandemic) by the largest US and European challengers in this space.

TRAVEL INDUSTRY DISRUPTORS INVEST IN MAXIMUM AUTOMATION

The tech disruptors are quietly evolving the business model beyond the aggregation of inventory to “controlling” selective parts of the value chain. The result – improved profitability and a uniform customer experience – requires a degree of investment in automation and the digitalisation of workflows for a fragment supplier base.

“[We’re] trusting that everything that can be automated will be – so companies in tech are of course best positioned to benefit – and we’re pursuing extreme automation and basically trying to automate everything.” – B2C Traveltech CEO

AGGREGATION AND CURATION ARE SYMBIOTIC

A common criticism of the travel industry is the overemphasis on aggregation, and the overwhelming options for travellers, at the expense of curation. Entrepreneurs in the space have emphasised that aggregation and curation are symbiotic. A high volume of inventory is needed to deliver on the specific traveller requirements necessary for curation and to provide the breadth of selection necessary to foster repeat bookings.

“For Hotel groups… competing in the lead-generation space with the likes of Booking.com is going to be almost impossible considering their marketing budget. So it comes down to retention… a hotel group needs to do its utmost to ensure the client comes back directly if they were to book again.”

“This comes down to the in-person relationship the hotel group can establish with guests during their stay. No matter how complex or intelligent technology is, it cannot compete with the joy of a physical face-to-face experience. It’s necessary to make the most of that opportunity; where you can enroll a user into a loyalty program or upsell other services in a physical space, where the [OTA] aggregators don’t exist.” – Hotel Executive

EMBEDDED PAYMENTS ARE A PRIORITY FOR MANY TRAVEL ENTREPRENEURS

Disruptors across every travel industry vertical are placing an increased emphasis on embedding payments into their platform. First, digital wallets offer merchants an opportunity to integrate payments, refunds, vouchers, and loyalty programs in a cost-efficient manner.

Second, the majority of OTAs offer customers the opportunity to buy now pay later (“BNPL”) and are enviously eyeing the margins (see diagram below) made by the likes of Klarna, Affirm and Afterpay in this space. Some entrepreneurs plan to roll-out white label BNPL offerings in the future.

‘BUY NOW, PAY LATER’ IS CHANGING CUSTOMER BUYING BEHAVIOR IN TRAVEL

BNPL has changed customer buying behaviour in the travel industry. BNPL provides OTAs with higher average order values (up to 40%) and increased conversion rates of (up to 50%) which is reflected in BNPL accounting for up to 20% of bookings by payment type.

The above diagram provides an indicative overview of BNPL monetisation and business model for travel companies. Whilst there are third-party fintechs – such as Divido – offering a white label BNPL in a box solution to merchants, the complexity and skillset required to operate an in-house BNPL business will significantly increase the execution risk. It is unlikely this will be a well-trodden path by entrepreneurs, given the number of BNPL players investing heavily in product and the competitive nature of the market.

SUSTAINABILITY IS A KEY COMPONENT OF FUTURE TRAVEL NORMS

Sustainability is a theme that is here to stay according to all entrepreneurs interviewed. Corporates, as highlighted previously, are demanding better metrics to better understand the actions required to become more sustainable. OTAs are building out new features to show if properties are powered by clean energy sources and more. It’s premature to conclude whether travellers are willing to pay higher accommodation rates for eco-friendly properties or whether these are overheads property owners will absorb.

“Business travellers represents a significantly bigger portion of our guests than most people would expect. However, this is likely to reduce significantly post-COVID and with a growing number of businesses looking at ways of reducing their own carbon footprints and costs now that remote working has proven to be viable” – Hotel Executive

KEY LEARNINGS FROM CEOs IN TRAVEL SPACE DURING THE COVID-19 PANDEMIC

An unknown going into the pandemic, as an investor in tech companies, was the ability of our management teams to make good decisions in adverse circumstances and demonstrate emotional intelligence. There was no vertical more challenging to be a CEO in the travel industry over the past 18 months. The digital survivors/winners in the travel tech space are raising fresh capital and embarking on the next chapter of growth. So, how did the CEOs steer their organisations to a position of strength?

Here are three learnings from the CEOs themselves:

“Never to take anything for granted and realise black swans happen.”

“Don’t make hasty decisions just because everything is chaos. When things are really shit, there’s lots of opportunities.”

“Being transparent and honest with people has good payback in the long run… if you bring bad news then, as long as you’re honest, people will appreciate it.”

We would like to say a final ‘thank you’ to Holidu, Exoticca, Headout, Travelstart, Roomex, Tripactions, Hilton, IHG, Accor, Howzat Partners for your travel industry insight.

[2] Interviewees in this report includes companies Claret Capital Partners (“Claret”) does and may seek to do business. This includes portfolio companies of funds managed and affiliated with Claret.

If you would like to learn more about the latest developments across the travel industry or if you would like to speak to a member of our team, simply enter your details in the form below and we’ll be in touch.